Page 105 - Ratti_bilancio di sostenibilità_2022_EN

P. 105

Ratti Group | Sustainability Report 2022

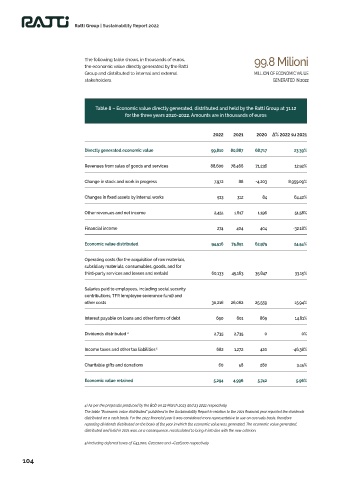

The following table shows, in thousands of euros, 99.8 Milioni

the economic value directly generated by the Ratti

Group and distributed to internal and external MILLION OF ECONOMIC VALUE

stakeholders. GENERATED IN 2022

Table 8 – Economic value directly generated, distributed and held by the Ratti Group at 31.12

for the three years 2020-2022. Amounts are in thousands of euros

2022 2021 2020 Δ% 2022 su 2021

Directly generated economic value 99,810 80,887 68,717 23.39%

Revenues from sales of goods and services 88,600 78,466 71,236 12.92%

Change in stock and work in progress 7,972 88 -4,203 8,959.09%

Changes in fixed assets by internal works 513 312 84 64.42%

Other revenues and net income 2,451 1,617 1,196 51.58%

Financial income 274 404 404 -32.18%

Economic value distributed 94,516 75,891 62,975 24.54%

Operating costs (for the acquisition of raw materials,

subsidiary materials, consumables, goods, and for

third-party services and leases and rentals) 60,133 45,163 35,847 33.15%

Salaries paid to employees, including social security

contributions, TFR (employee severance fund) and

other costs 30,216 26,062 25,559 15.94%

Interest payable on loans and other forms of debt 690 601 869 14.81%

Dividends distributed 4 2,735 2,735 0 0%

Income taxes and other tax liabilities 5 682 1,272 420 -46.38%

Charitable gifts and donations 60 58 280 3.45%

Economic value retained 5,294 4,996 5,742 5.96%

4) As per the proposals produced by the BoD on 22 March 2023 and 23 2022 respectively.

The table “Economic value distributed” published in the Sustainability Report in relation to the 2021 financial year reported the dividends

distributed on a cash basis. For the 2022 financial year it was considered more representative to use an accruals basis, therefore

reporting dividends distributed on the basis of the year in which the economic value was generated. The economic value generated,

distributed and held in 2021 was, as a consequence, recalculated to bring it into line with the new criterion.

5) Including deferred taxes of €43,000, €207,000 and -€226,000 respectively

104